Managing Risk with ESG Investing

Companies that pay attention to environmental issues, corporate governance and society’s needs tend to perform well in volatility.

NT Asset ManagementFollowSep 11 · 7 min read

by Emily Lawrence, director of sustainable investing for the institutional sales group, and Sharee Zlatkova, investment associate for sustainable investing

In addition to the significant toll taken on human health and well-being, the scale of the economic impacts stemming from the COVID-19 crisis has also been stunning. We must acknowledge that the health and well-being of our financial system is inextricably linked to a healthy, engaged global society and workforce. Our investment thesis acknowledges that ESG issues are business issues; when managed well, these factors can position a company for success. When managed poorly, they can lead to negative externalities that can result in reputational and financial risk, and that has been borne out during the market downturn.

Mitigating Risks with ESG

Our observations of the way companies are responding to this systemic distress highlights the importance of integrating ESG (environmental, social and governance) analytics into the investment process. Investors can integrate ESG data to create a more holistic view of risks and opportunities — resulting in more informed investment decisions and resilient portfolios during times of market downturn. One example of this is ESG funds compared to non-ESG funds in the first quarter. According to a study done by Morningstar, 70% of sustainable equity funds ranked in the top halves of their categories and 44% ranked in the best performing quartile.

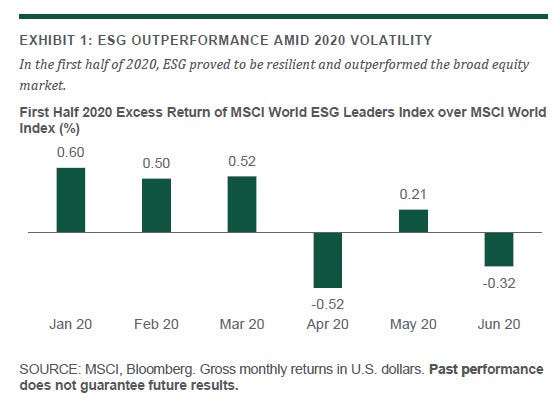

This observation on ESG outperformance can be seen across asset classes. Take for example the global developed equity index MSCI World Index versus the MSCI ESG World Leaders Index. MSCI designed the ESG index family to leverage ESG risk ratings to provide relatively low tracking error and broad market exposure. The series launched in late 2007, and during its life cycle has largely performed in line with the world benchmark. The World Leaders index outperformed its cap-weighted parent by 1.1% in the first half of the year, which was 84% driven by the security selection during this time period. This index’s performance was particularly strong during the significant volatility seen during the first quarter. Exhibit 1 outlines that relative performance.

Looking into the drivers of the outperformance, we group the securities by their individual environmental, social and governance scores into three categories of leaders, average and laggards. Not surprisingly, the ESG leaders minus laggards are positive across all three metrics, with the spread in governance the largest at nearly 6%. Companies that lead the pack on the social dimension outperformed their laggard counterparts by 4.4%, an interesting indicator underscoring the adept way the leader companies respond to their stakeholders.

How ESG Performed in Emerging Markets

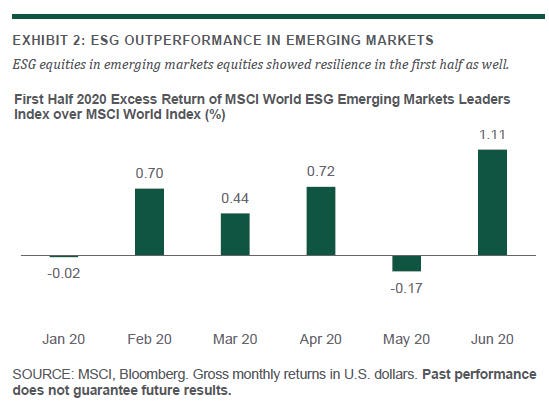

Similarly, within emerging markets equities, the MSCI ESG Emerging Markets Leaders Index outperformed the MSCI World Index by 2.5% through the first six months of the year, half of which was driven by the security selection. Again, performance shown in Exhibit 2 during the middle of the first quarter, at the height of the volatility, speaks for itself.

Similar Results for Bonds and ESG

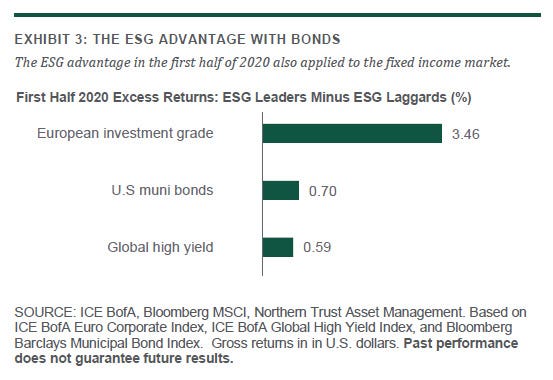

Within the fixed income asset class, similar results were observed across the various markets between the ESG leaders and laggards. Using the MSCI ESG scores for the investment-grade and high-yield constituents with our proprietary U.S. municipal sustainability rating, we see consistently stronger performance of the issuers which exhibit more robust ESG profiles.

In addition to stronger returns by the ESG leaders, they also traded at tighter spreads during the market stress, even though there is only a loose correlation between ESG profiles and credit ratings. As a risk control asset, these characteristics are important factors for investors looking for consistency in downside mitigation, another interesting proof statement for our sustainable investing philosophy. For more insight into our approach to sustainable fixed income, see the blog What Happened with ESG and Quality in Bond Market Turmoil.

Responding to Change

As investors respond to the systemic risks presented by the coronavirus, there is no doubt that this crisis has brought to light questions regarding the management of workers’ health and safety, employee financial security, supply chain disruptions and risk management protocols.

In the act of advising on how to respond during this crisis, the United Nation’s Principles for Responsible Investing (PRI) and United Nations Global Compact both released guidance for investors and businesses to consider as responsible investors and ethical business leaders. One of the immediate actions PRI encourages investors to do is engage with companies who are failing their crisis management. This means talking to companies who are failing to protect worker’s either by not providing a clean and safe work environment, protective equipment, or unfair sick leave. As active owners, in our own discussions with companies we try to make sure that employee and contractor health and safety and robust governance of sustainability issues are among their highest priorities. We discuss with companies how they are managing these risks as well as understanding the targets and improvements they are trying to achieve.

ESG for Today and the Long-Term

The market stress brought on by the COVID-19 crisis has changed the investment landscape, and investors are responding by allocating further to sustainable investing strategies. By evaluating and engaging on issuers’ ESG characteristics, investors not only mitigate portfolio risk but also contribute to promoting the health of the market overall. We observe a growing cohort of investors acknowledging the relevance and materiality of ESG characteristics to the investment management process, and we anticipate that the events surrounding COVID-19 will act as a catalyst, drawing more investors to adopt this philosophy as a means of promoting long term value creation in their portfolios.

Learn more about sustainable investing at Northern Trust Asset Management.

How is this blog post? Click one: Like it — Just okay — Don’t like it

IMPORTANT INFORMATION. For Asia-Pacific markets, this information is directed to institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of Northern Trust and are subject to change without notice.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. Information is subject to change based on market or other conditions.

Forward-looking statements and assumptions are Northern Trust’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

Past performance is no guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by Northern Trust. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc. Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K, NT Global Advisors Inc., 50 South Capital Advisors, LLC and investment personnel of The Northern Trust Company of Hong Kong Limited, Belvedere Advisors, LLC and The Northern Trust Company.

© 2020 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.

https://pointofview.northerntrust.com/managing-risk-with-esg-investing-43d8d07c4674