Determining the Financial Impact of ESG Investing

RESEARCH INITIATIVE

Source >>>

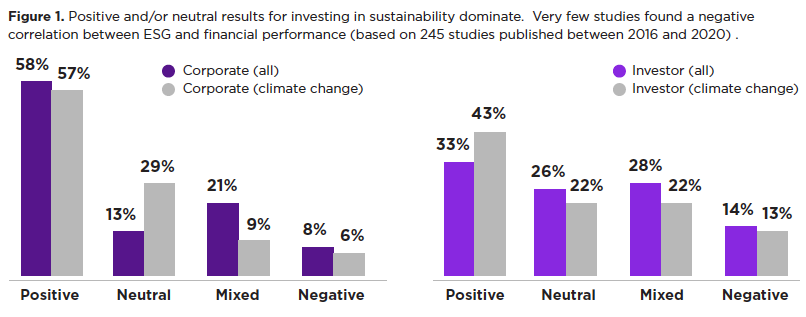

Uncovering the relationship between ESG and financial performance through meta-analysis of 1,000+ studies

Meta-studies examining the relationship between environmental, social, and governance (ESG) and financial performance have a decades-long history. Almost all the articles they cover, however, were written before 2015. Those analyses found positive correlations between ESG performance and operational efficiencies, stock performance and lower cost of capital. Five years later, we have seen exponential growth in ESG and impact investing – due in large part to increasing evidence that business strategy focused on material ESG issues is synonymous with high-quality management teams and improved returns.

In collaboration with Rockefeller Asset Management and Casey Clark, CFA (MBA ’17), the NYU Stern Center for Sustainable Business examine the relationship between ESG and financial performance in more than 1,000 research papers from 2015 – 2020.

To download the full report, click here.

To read the media announcement from February 2021, click here.

About the Research Methods

Because of the varying research frameworks, metrics and definitions, we decided to take a different approach than previous meta-analyses. We divided the articles into those focused on corporate financial performance (e.g. operating metrics such as ROE or ROA or stock performance for a company or group of companies) and those focused on investment performance (from the perspective of an investor, generally measures of alpha or metrics such as the Sharpe ratio on a portfolio of stocks), to determine if there was a difference in the findings. We also separately reviewed papers and articles focused on low carbon strategies tied to financial performance in order to understand financial performance implications through the lens of a single thematic issue.

KEY TAKEAWAYS

1. Improved financial performance due to ESG becomes more noticeable over longer time horizons

We found that our proxy for an implied long-term relationship had a coefficient with a positive sign that is statistically significant. The model suggests that, everything else being constant, a study with an implied long-term focus is 76% more likely to find a positive or neutral result.

2. ESG integration as an investment strategy performs better than negative screening approaches

he sample size of studies on specific portfolio management strategies and asset classes was small, making it challenging to interpret how they would translate into decision-making for an asset manager. The dominant research approach was to find a sample of sustainable funds or indices and compare them to a conventional benchmark.

3. ESG investing provides downside protection, especially during a social or economic crisis

ESG investing appears to provide asymmetric benefits. Investor studies, in particular, seem to demonstrate a strong correlation between lower risk related to sustainability and better financial performance. Recent events have provided unique datasets for researchers.

4. Sustainability initiatives at corporations appear to drive better financial performance due to mediating factors such as improved risk management and more innovation

Sustainability strategies implemented at the corporate level can drive better financial performance through mediating factors—i.e. the sustainability drivers of better financial performance such as more innovation, higher operational efficiency, better risk management, and others, as defined in the Return on Sustainability Investment (ROSI) framework (Atz et al., 2019).

5. Studies indicate that managing for a low carbon future improves financial performance

Research on mitigating climate change through decarbonization strategies is fairly recent, but finds strong evidence for better financial performance for both corporates and investors.

6. ESG disclosure on its own does not drive financial performance

Just 26% of studies that focused on disclosure alone found a positive correlation with financial performance compared to 53% for performance-based ESG measures (e.g. assessing a firm’s performance on issues such as greenhouse gas emission reductions). This result holds in a regression analysis that controls for several factors simultaneously.To download the full report, click here.